"Every business in America should be on this plan."

Proposal Calculator | Get Started | Covered Benefits | Tax Advantages | Pricing | Brochure

Executive Medical Reimbursement

BeniComp Select protects your key employees from out-of-pocket medical, dental, vision, and hearing expenses that are not covered by your company’s regular health care programs.

Why BeniComp Select?

BeniComp has been in business since 1962, and is the largest executive medical reimbursement company in the country providing:

- Excellent customer service

- Favorable plan provisions

- No waiting period

- Range of benefit options (Based on number of covered employees)

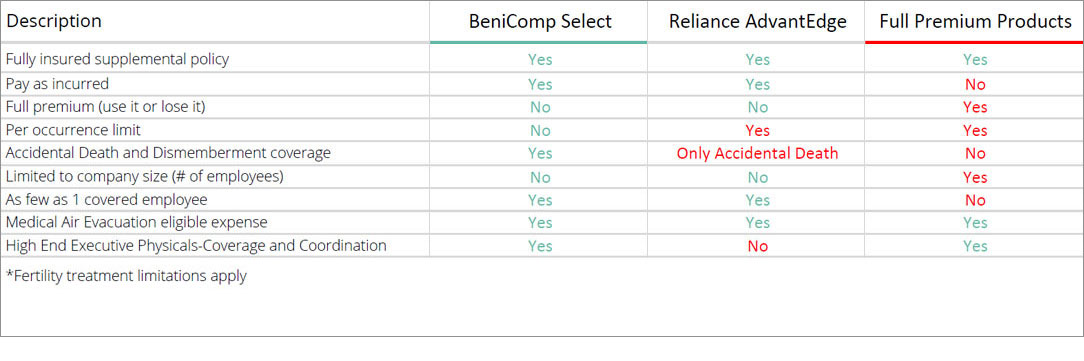

Below you will find a quick comparison chart that explores the similarities and differences between BeniComp Select, other similar programs, and full premium vendors. As illustrated below, we are the most robust, competitive product in the marketplace today.

What Is An Executive Medical Reimbursement Plan?

BeniComp Select is a fully insured, supplemental, group executive medical expense reimbursement insurance policy. It allows employers to reimburse their key employees for medical expenses not otherwise covered by health insurance.

Covered Benefits for Select Employees and Their Dependents

- Prescription drugs

- Dental and orthodontic expenses

- Vision Care including all types of frames

- Chiropractic services

- Hearing aids and Otologic examinations

- Deductibles

- Smoking cessation clinics

- Weight loss programs

- Charges for the diagnosis of infertility

- Charges for the treatment of infertility up to 10% of annual maximum per calendar year

- Medical transportation, including air services and hotel (limitations apply)

- Psychiatric care

- Speech therapy

- Private-duty nursing

- Hospital expenses, including private-room charges

- Home health care

- Alcoholism and drug-abuse treatment and facilities

- Inpatient and outpatient psychiatric care

- Medical supplies and equipment and many more services

Generally, if an expense is medically necessary and qualifies under Section 213 it would be eligible for reimbursement under this plan. For a more comprehensive list and details view IRS Publication 502. Individuals must be under the care of a legally qualified physician to receive reimbursement.

Elective procedures that are not medically necessary are not covered by BeniComp Select. For more information check our FAQs.

Tax Advantages And Benefits

- Insurance benefits (reimbursements) are generally non-taxable income

- Recruitment and retention of key executives

- Flexible benefit schedule

- Enhanced medical plans for as many or as few employees as you choose

- Reduced out-of-pocket expenses

- No age limit

- No pre-existing illness limitation

- Easy claim submission

It is strongly recommended that interested parties seek the advice of tax counsel when considering adopting an Insured Medical Supplemental Plan.

What Does It Cost?

-

Annual cost = $350/yr for each covered employee

-

Variable premium = Paid claims + 12% administration cost

-

Accidental Death and Dismemberment Benefit is equal to the annual maximum up to $100,000 at no additional cost